Cryptocurrency staking has become a popular way for investors to earn passive income while supporting blockchain networks. As an alternative to traditional mining, staking offers a more energy-efficient way to validate transactions and secure blockchain networks. But what exactly is staking, and how does it work? In this guide, we’ll explore the fundamentals of staking, its benefits, risks, and how you can get started.

What Is Staking?

Staking is the process of locking up cryptocurrency tokens in a blockchain network to help validate transactions and secure the network. In return, participants (stakers) earn rewards, often in the form of additional tokens. Staking is commonly associated with blockchains that use the Proof of Stake (PoS) consensus mechanism.

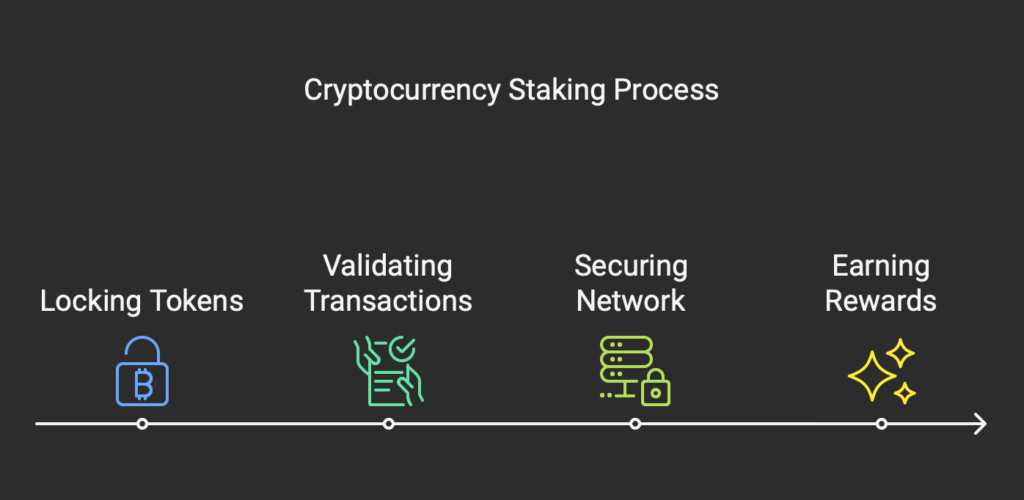

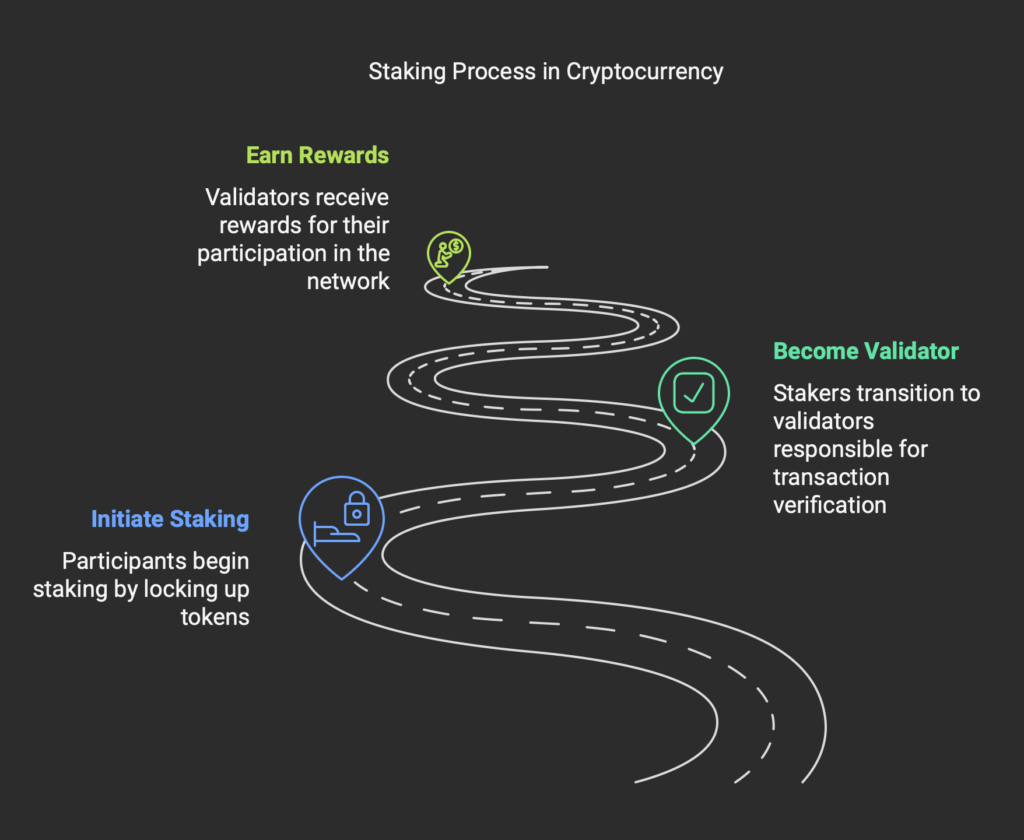

How Does Staking Work?

- Proof of Stake (PoS): Staking replaces traditional mining by allowing participants to validate transactions based on the number of tokens they hold and lock up, rather than computational power.

- Validators: Stakers become validators, responsible for verifying transactions and adding new blocks to the blockchain.

- Rewards: In exchange for their participation, validators receive staking rewards, typically a percentage of the transaction fees or newly minted tokens.

Why Do Blockchains Use Staking?

Staking plays a critical role in maintaining the security and efficiency of blockchain networks. Here’s why blockchains use staking:

- Energy Efficiency: Unlike Proof of Work (PoW), staking requires significantly less energy.

- Network Security: Staking incentivizes participants to act honestly, as malicious behavior can result in the loss of staked tokens.

- Scalability: PoS blockchains often handle more transactions per second compared to PoW networks.

Benefits of Staking

1. Passive Income

Staking allows you to earn rewards by simply holding and locking up your cryptocurrency.

2. Eco-Friendly

Staking is much more energy-efficient than traditional mining, making it an environmentally friendly choice.

3. Network Participation

Stakers contribute to the security and decentralization of the blockchain network.

4. Increased Token Utility

Staking adds utility to your tokens by enabling you to earn rewards and participate in network governance.

Risks of Staking

While staking offers many benefits, it’s not without risks. Here are some of the key risks to consider:

- Market Volatility: The value of your staked tokens can fluctuate, affecting the overall profitability of staking.

- Lock-Up Periods: Some staking protocols require you to lock up your tokens for a set period, limiting liquidity.

- Slashing: Validators that act dishonestly or fail to meet network requirements may lose a portion of their staked tokens.

- Platform Risks: Staking through third-party platforms can expose you to additional risks, such as platform hacks or mismanagement.

Cryptocurrency Staking vs. Lending: What’s the Difference?

If you’re exploring ways to earn passive rewards with cryptocurrency, you might have encountered platforms like BlockFi or Linus offering up to 9.5% APY on your holdings. While this might sound similar to staking, there are key differences between staking and lending.

Crypto Lending

On platforms like BlockFi, your earnings come from the platform lending out your cryptocurrency to borrowers. While this can be lucrative, it carries the risk of borrower default, which could erase investor gains. Although BlockFi has stated that defaults haven’t occurred to date, it’s still a possibility to consider.

Platforms like Celsius offer interest rates as high as 17% on various cryptocurrencies and stablecoins, providing more flexibility than staking. With lending, you can earn interest on non-PoS cryptocurrencies and stablecoins, which broadens your investment options.

Key Similarities and Differences

Both staking and lending allow you to earn passive rewards with cryptocurrency. However, staking typically involves supporting blockchain networks, while lending resembles traditional banking, where your funds are lent to others. Both methods carry risks such as market volatility, and in the case of lending, the risk of borrower default. Before committing, conduct thorough research and determine the amount of cryptocurrency you’re comfortable staking or lending.

How to Get Started with Staking

1. Choose a Cryptocurrency

Popular staking coins include:

- Ethereum (ETH): With the transition to Ethereum 2.0, ETH staking has become a major opportunity.

- Cardano (ADA): Known for its robust staking rewards and eco-friendly blockchain.

- Polkadot (DOT): Offers flexible staking options and strong network participation.

- Solana (SOL): A high-performance blockchain with attractive staking rewards.

2. Select a Staking Method

- Direct Staking: Stake directly through a wallet or the blockchain’s native staking platform.

- Staking Pools: Join a pool where multiple participants combine their tokens to increase their chances of earning rewards.

- Centralized Exchanges: Platforms like Coinbase, Binance, and Kraken offer simplified staking services.

3. Set Up a Wallet

Choose a wallet compatible with your staking cryptocurrency. Examples include:

- Ledger and Trezor: Secure hardware wallets for staking.

- Exodus Wallet: A user-friendly software wallet.

- MetaMask: A popular choice for Ethereum staking.

4. Stake Your Tokens

Follow these steps:

- Transfer your tokens to the staking platform or wallet.

- Select the amount of tokens to stake.

- Confirm the transaction and start earning rewards.

Where Can You Stake Crypto?

Here are some of the most popular platforms for staking:

- Centralized Exchanges

- Binance: Offers staking for a wide range of cryptocurrencies.

- Coinbase: A beginner-friendly platform with staking options for Ethereum and other tokens.

- Kraken: Known for its competitive staking rewards.

- Decentralized Platforms

- Lido Finance: Specializes in Ethereum staking.

- StakeFi: Supports staking across multiple blockchains.

- Native Wallets

- Cardano Wallets: Daedalus and Yoroi for ADA staking.

- Polkadot Wallets: Polkadot.js and Ledger for DOT staking.

Staking Rewards: What to Expect

The rewards for staking vary depending on the cryptocurrency and platform. Here are some examples:

- Ethereum (ETH): 4-6% annually.

- Cardano (ADA): 5-7% annually.

- Polkadot (DOT): 10-14% annually.

- Solana (SOL): 6-8% annually.

Future of Staking

Staking is poised to play an even more significant role in the blockchain ecosystem. Key trends to watch include:

- Expansion of PoS Networks: More blockchains are adopting Proof of Stake due to its efficiency and scalability.

- Liquid Staking: Innovative solutions like liquid staking allow users to access their staked tokens’ value without unstaking them.

- Increased Institutional Participation: Institutions are showing interest in staking as a reliable source of passive income.

- Integration with DeFi: Staked tokens are increasingly being used within decentralized finance applications.

Conclusion

Staking is a powerful tool for earning passive income while contributing to the security and efficiency of blockchain networks. By understanding the basics, benefits, and risks, you can make informed decisions about participating in staking. Whether you’re a beginner or an experienced crypto investor, staking offers a way to maximize your holdings and play a role in the future of decentralized technology.

Call to Action: Ready to start staking? Visit The Finance Bot for expert guides, resources, and tips to help you navigate the staking landscape!